BANK INSTRUMENT

BANK GUARANTEE

What is a Bank Guarantee?

A bank guarantee often referred to as BG is a guarantee from a lending institution ensuring the liabilities of a debtor will be met. In other words, if the debtor fails to settle a debt, the bank covers it. We can simply say that a bank guarantee is a promise from a bank or other lending institution that if a particular borrower defaults on a payment, the bank will cover the loss. Note that a bank guarantee is not the same as a letter of credit.

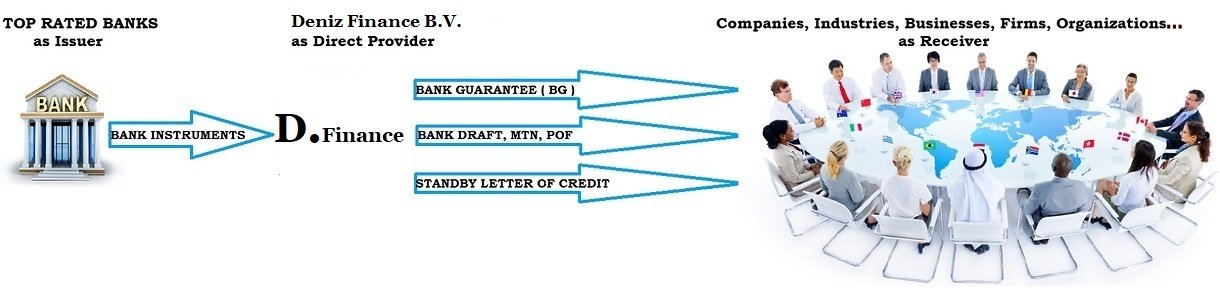

Need a Bank Guarantee from HSBC, Barclays Bank or Credit Suisse?

Just because these top-rated banks do not know you enough, they may be reluctant to issue a guarantee directly to you which is why we continue to be a linking bridge between you and these banks making it possible for you to either lease a bank guarantee to be issued in our name or purchase a fresh cut bank guarantee to be issued in your name. Even though a leased or purchased bank guarantee is valid for business, leasing a bank guarantee costs 4% of the amount on the bank guarantee generally known as the face value and cannot be monetized, while purchasing costs 30% and can be monetized.

Brokers benefit 2% of the bank guarantee face value on each issuance

How can I get a Bank Guarantee?

1. Send us your Customer Information Sheet, Preferred Verbiage, Passport copy and Company Registration/Incorporation Certificate for Due Diligence and Verification,

2. Upon Approval, we send you a Deed of Agreement, (DOA),

3. Send us the signed contract and make an initial payment to cover the processing fee,

4. Our bank sends you Pre-Advice RWA MT799,

5. Our bank sends you a Bank Guarantee MT760,

6. You either remit the leasing/purchasing cost in ninety days or we monetize the Bank Guarantee (only purchased Bank Guarantees can be monetized).

We only monetize purchased Bank Guarantees at 80% LTV

How can I monetize a Bank Guarantee?

For Bank Guarantees provided in-house,

1. Fill a Deed of Agreement, (DOA),

2. Within 10 working days, we monetize your Bank Guarantee,

3. Within 3 banking days, we pay you 80% of the Bank Guarantee total value.

What is a Standby Letter of Credit?

A Standby Letter or Credit or a Letter of Credit often referred to as SBLC or LC respectively is an irrevocable documentary commitment, issued by the bank to a third-party beneficiary, confirming holders as creditworthy and/or promising to pay on behalf of the originator. Our major involvement with the banks, considering very many previous successful leasing and purchasing, reduces the pressure to obtain the SBLC, making the document even more readily available for our end receivers after performing general underwriting duties to ensure the financial credibility of the party seeking the letter of credit.

Need a Standby Letter of Credit from HSBC, Barclays Bank or Credit Suisse?

Just because these top-rated banks do not know you enough, they may be reluctant to issue an SBLC directly to you which is why we continue to be a linking bridge between you and these banks making it possible for you to either lease a standby letter of credit to be issued in our name or purchase a fresh cut standby letter of credit to be issued in your name.

Even though a leased or purchased SBLC is valid for business, leasing an SBLC costs 4% of the amount on the standby letter of credit generally known as the face value and cannot be monetized, while purchasing costs 30% and can be monetized.

Brokers benefit 2% of the SBLC face value on each issuance.

How can I get a Standby Letter of Credit?

If you do not have a fixed deposit with us, follow these simple procedures to receive an SBLC.

1. Send us your Customer Information Sheet, Preferred Verbiage, Passport copy and Company Registration/Incorporation Certificate for Due Diligence and Verification,

2. Upon Approval, we send you a Deed of Agreement, (DOA),

3. Send us the signed contract and make an initial payment to cover the processing fee.

4. Our bank sends you Pre-Advice RWA MT799,

5. Our bank sends you a Standby Letter of Credit MT760,

6. You either remit the leasing/purchasing cost in ninety days or we monetize the Standby Letter of Credit (only purchased Standby Letter of Credit can be monetized).

We only monetize purchased Standby Letter of Credit at 80% LTV

How can I monetize a Standby Letter of Credit?

For Standby Letter of Credit provided in-house,

1. Fill a Deed of Agreement, (DOA),

2. Within 10 working days, we monetize your Standby Letter of Credit,

3. Within 3 banking days, we pay you 80% of the Standby Letter of Credit total value.

What is a Bank Draft?

A bank draft is a check from one bank to another bank for payment in the name of a particular person or organization for remittance purposes.

Need a Bank Draft?

Just because these top-rated banks do not know you enough or because organizations might not have the cash-at-hand to request for a bank draft, banks may be reluctant to issue a bank draft which is why we continue to be a linking bridge between you and these banks making it possible for you to obtain a bank draft at a 5% charge i.e. Beneficiary remits 5% of the total face value on the bank draft as cost.

Brokers benefit 1% of the bank draft's face value on each issuance

How can I get a Bank Draft?

For Investors who have a fixed deposit with us, you do not need to worry about procedures.

- Fill a Deed of Agreement, (DOA),

- We request and obtain a Bank Draft MT110 sent over to you,

- Remit the leasing or purchasing cost.

If you do not have a fixed deposit with us, follow these simple procedures to receive a bank draft. - Send us your Customer Information Sheet, preferred Verbiage and Company Certificate for Due Diligence,

- Fill a Deed of Agreement, (DOA),

- Make an initial payment to cover the processing fee,

- Acknowledge RWA MT799,

- We request and obtain a Bank Draft MT110 sent over to you,

- Remit the leasing or purchasing cost in ninety days.

Did you lose a bank draft provided to you by Deniz Finance B.V.?

Lost a bank draft provided to you by Deniz Finance B.V., or was it destroyed at the cleaner’s because you forgot it in a pair of pants? We got your back...

Contact Deniz Finance B.V., we keep lasting records of every deal completed through us. We always have a copy of the non-negotiable part. We will gladly get in contact with the bank who in turn will verify that the bank draft has not yet been cashed and will issue us another one knowing that we are financially solvent, and we shall simply deliver your bank draft to you again.

SWIFT MT Messages

A list of SWIFT MT messages for Payments and Trade Services is provided below.

SWIFT MT Messages

Customer Payments & Checks

101 Request for Transfer

102 / 102+ Multiple Customer Credit Transfer

103 / 103+ / 103 REMIT Single Customer Credit Transfer

104 Direct Debit and Request for Debit Transfer Message

105 EDIFACT Envelope

106 EDIFACT Envelope

107 General Direct Message

110 Bank Draft/Advice of Cheque(s)

111 Request for Stop Payment of a Cheque

112 Status of a Request for Stop Payment of a Cheque

199 Free Format Message

Treasury Markets–Foreign Exchange, Money Markets & Derivatives

300 Foreign Exchange Confirmation

303 Forex/Currency Option Allocation Instruction

304 Advice/Instruction of a 3rd Party Deal

305 Foreign Currency Option Confirmation

306 Foreign Currency Option Confirmation

307 Advice/Instruction of a 3rd Party FX Deal

308 Instruction for a Gross/Net Settlement of 3rd Party FX deals

320 Fixed Loan/Deposit Confirmation

321 Instruction to Settle a 3rd Party Loan /Deposit

330 Call/Notice (Loan/Deposit Confirmation)

340 Forward Rate Agreement Confirmation

341 Forward Rate Agreement Settlement Confirmation

350 Advice of Loan/Deposit Interest Payment

360 Single Currency Interest Rate Derivative Confirmation

361 Cross Currency Interest Rate Swap Confirmation

362 Interest Rate Reset/Advice of Payment

364 Single Currency Interest Rate Derivative Confirmation

365 Cross Currency Interest Rate Swap Termination/Recouping Confirmation

380 Foreign Exchange Order

381 Foreign Exchange Order Confirmation

Documentary Credits & Guarantees

700 Issue of Documentary Credit

701 Issue of Documentary Credit

705 Pre-Advice of a Documentary Credit

707 Amendment to a Documentary Credit

710 Advice of a 3rd Bank’s Documentary Credit

711 Advice of a 3rd Bank’s Documentary Credit

720 Transfer of a Documentary Credit

721 Transfer of a Documentary Credit

730 Acknowledgement

732 Advice of Discharge

734 Advice of Refusal

740 Authorisation to Reimburse

742 Re-imbursement Claim

747 Amendment to an Authorisation to Reimburse

750 Advice of Discrepancy

752 Authorization to Pay, Accept or Negotiate

754 Advice of Payment/Acceptance/Negotiations

756 Advice of Re-imbursement or Payment

760 Bank Guarantee/Standby Letter of Credit

767 Bank Guarantee/ Standby LC Amendment

768 Acknowledgement of a Guarantee/ Standby LC Message

769 Advice of Reduction or Release

799 Authenticated Free Format Message

Cash Management & Customer Status

900 Confirmation of Debit

910 Confirmation of Credit

920 Request Message

935 Rate Change Advice

940 Customer Statement Message

941 Balance Report

942 Interim Transaction Report

950 Statement Message

960 Request for Service Initiation Message

961 Initiation Response Message

962 Key Service Message

963 Key Acknowledgement Message

964 Error Message

965 Error in Key Service Message

966 Discontinue Service Message

967 Discontinuation Acknowledgement Message

970 Netting Statement

971 Netting Balance Report

972 Netting Interim Statement

973 Netting Request Statement

985 Status Enquiry

986 Status Report

999 Free Format Message